Finding

Seasonal Spreads

Paul

Teetor

Many spreads show seasonality -- that is, regular patterns from

year-to-year -- and can be a valuable source of profits and

diversification. Seasonal spreads, however,

seem

to get little attention from the quantitative community.

I’d like to remedy that by showing one way to identify

seasonal

spreads using legitimate statistical techniques. I'll start

with

an example of a seasonal spread: crude oil versus

gasoline.

Example: Crude oil versus

gasoline

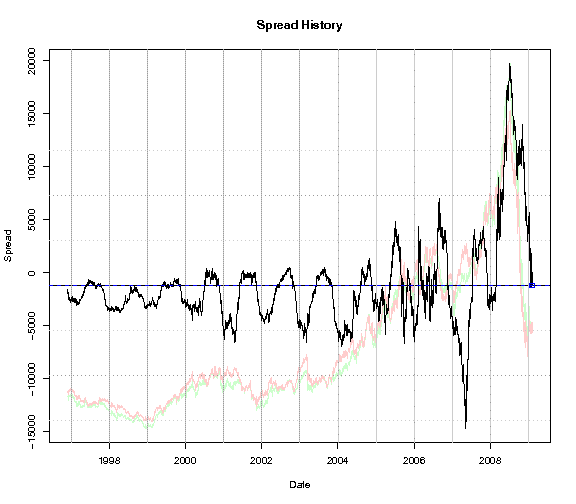

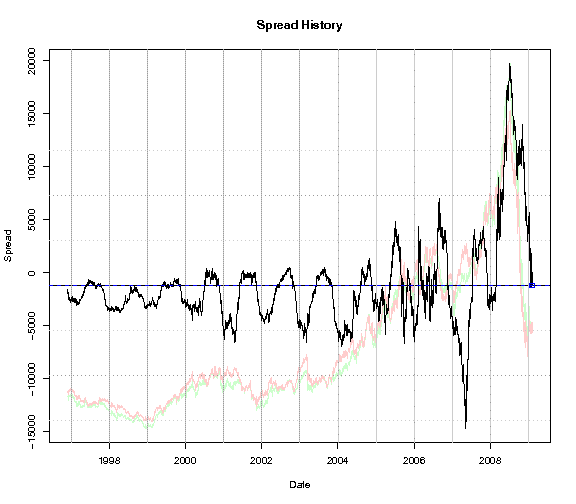

Here is a chart of the spread between crude oil futures (CL) and

gasoline futures (RB) from 1997 to the present, covering about 12 years

of history.

If you look closely, it appears that the spread often falls during

Winter, then rises from Spring into Summer. But how can we be

sure? Perhaps we are just imagining the pattern, based on a

few

examples. And what are the actual months when it falls and

rises?

Here is how we can test for a seasonal pattern.

- Compute the daily change in

the spread, st,

giving us one Δst

value for every day of the spread’s history.

- For each day, group the

day’s change according to the month

of that day.

- Compute the average change

for each monthly group.

That will give a table such as this, with one mean change (µ)

for

every month, taken over all the years of spread history.

| |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| Mean change |

-31.97 |

52.15 |

-16.74 |

12.98 |

94.73 |

78.16 |

33.08 |

-12.39 |

-18.88 |

22.77 |

-121.50 |

-90.37 |

(These averages are in dollars per day.)

The monthly averages suggest trades: January is a down month,

on

average,

so sell the spread during January. Likewise, February is an

up

month, on average, so buy the spread during February.

Those trades would be very naïve, however. A

statistician

would ask an important question before risking real money:

What

is probability that the true mean is actually positive or

negative? The averages for April and August are pretty small

(12.98 and -12.9), for example. Maybe our sample is too

small,

and these averages are not representative. How realistic are

these numbers?

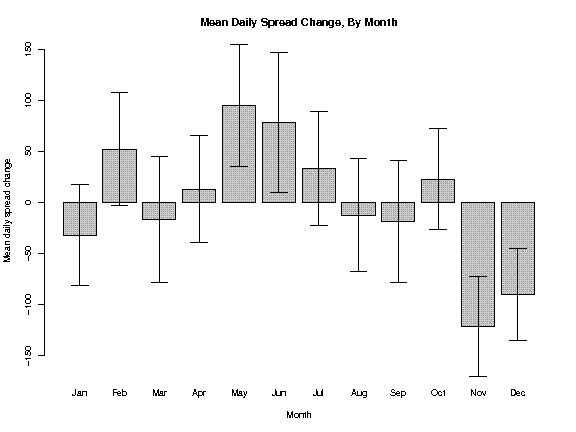

The solution is to form confidence intervals for each monthly

mean. This barchart shows the mean change taken from the

table

above, then superimposes the confidence intervals over each bar, giving

us a composite view of the monthly averages.

Consider the bar for January. Yes, the mean change is

negative,

but the confidence interval crosses over into positive

territory.

Statistically speaking, we cannot be

confident that the true mean is

negative. It could

be zero or even positive, so selling

the

spread during January could be unwise. In fact, the

confidence

interval includes zero for most months, and we cannot be confident

there is any seasonal trend in those months, either positive or

negative.

The confidence interval for May, however, is completely

positive.

We can be confident that the average historical daily change in May is

positive. In fact, May and June are clearly

“up”

months, and November and December are clearly

“down”

months. Now we have our seasonal trade for the CL/RB spread:

- Buy the spread on May

1. Close the position on Jul 1.

- Short the spread on Nov

1. Close the position on Jan 1.

Finding Seasonal Spreads

Automatically: ANOVA

This analysis would be quite tedious if we performed it manually for

every spread we know. Fortunately, we can use ANOVA to

automatically identify seasonality in spreads.

ANOVA stands for analysis of variance.

ANOVA compares groups of

observations, such as our month-wise groups of spread

changes. It

reports the probability that one or more groups have significantly

different means, compared with the other groups.

The ANOVA report includes a probability

value, or simply p-value,

which

is the probability that all the means are identical. So a

small

p-value

means one or more

groups are probably not the same. In

the CL/RB example, above, my computer reports a p-value

of less than

0.0001, so the probability that all months have the same average change

is less than 0.01%.

My computer runs a weekly batch job which computes the ANOVA p-value

for every spread in my database. If the p-value

is 0.05 or less,

I know there is a 95% probability that the spread changes are

significantly different from month-to-month; in other words, the spread

exhibits a seasonal pattern. In those cases, the batch job

saves

the p-value

in the

database. Later, I run a report to select the

spreads with the best (i.e., smallest) p-values.

Those are my

candidates for seasonal trades.

The computer tests every combination of stocks and futures, so it

occasionally reports a bizarre seasonal spread. It recently

discovered that the spread between British Pound futures (BP) and Live

Cattle (LC) shows seasonality at a confidence level of 96% or

better. Would I trade the BP/LC spread? Of course

not,

because I cannot discern the economic logic of the trade.

Limitations

This analysis is not an automated trading system and has important

limitations.

- The analysis does not make a

prediction. It only reports

the past pattern. When you trade that pattern, you are

assuming

this year is like other years.

- The basic ANOVA analysis

only reports that some months are

different, not which months are different. The trader must

look

at monthly pattern to choose the right time for the trade.

- The trade decision must also

incorporate the current market

conditions. For example, if the history recommends buying but

the

spread is already quite high, the trade could be unwise.

- This analysis looks at

monthly patterns. The seasonal

patterns at other boundaries might be more distinct and, hence, better

trades.

Next Steps

We can augment this analysis by computing the spread’s Z

score,

then selecting trades which show harmony between their historical

pattern and current status. We can also improve the analysis

by

incorporating a seasonal version of the Ornstein-Uhlenbeck

formula,

letting us predict the time-to-profit. I hope to cover these

subjects in the future.

Additional Details For the

Curious

The data for the CL/RB spread, above, was purchased from Commodity

Systems Inc. (CSI), using their

Perpetual Contact data. This

example was as of Feb 5, 2009.

When I say “long the

CL/RB spread”, I mean buy CL and

sell RB. Likewise, “short the spread”

means sell CL

and buy RB.

I compute the hedge ratios for

my spreads using ordinary least

squares, as suggested in Ernie

Chan's book. The ratio for

the

CL/RB spread, above, was 1.1376 CL contracts for each RB contract.

Notice that I compute the

spread change,

not the spread

return.

Quants usually

study price returns, but that won’t

work with spreads because the spread can be zero, giving an undefined

return. The daily change follows a similar bell-shaped

distribution, so it’s a reasonable object for study.

I monitor about 115 stocks and

futures, so I have about 6,670

spreads to be tested weekly. A typical recent run found that

over

270 spreads that exhibit some seasonality, or about 4% of those

tested. The ANOVA batch job requires about 2-1/2 hours to

complete on my computer. The software is written in a

combination

of Perl

and R,

the free statistical software

system, running under

Linux.

References

The original and still-the-best book on seasonality is Seasonality:

Systems, Strategies, and Signals,

by Jake Bernstein. Some

of the

ideas in this analysis were inspired by Bernstein’s book.

Most good textbooks on

statistics discuss ANOVA. There is an

article

on

Wikipedia, but it is not a

tutorial.

Any decent software for

statistics includes the ANOVA

analysis. That includes R

and Octave,

which

are both free.