A Spread Trade for IEF

DRAFT

Paul Teetor

Summary

The iShares

Barclays 7-10

Year Treasury Bond Fund (NYSE: IEF), is an exchange-traded fund

which holds primarily intermediate-term US

Treasury Notes. As the name suggests, the maturities of the

holdings range from 7 to 10 years.

I wanted to determine if IEF could be hedged or replicated using a

combination of Treasury futures. If so, it might be possible

to trade the spread between IEF and futures. I initially

modeled

the hedge/spread using Eurodollar, 2-year, 5-year, and

10-years futures.

The final model, however, required

only

the 10-year futures. Furthermore, the model residuals are

demonstrably

mean-reverting, which naturally leads to relative value trades.

This is very encouraging because it

suggests a simple spread -- IEF versus

10-year Treasury Note futures -- could be profitably traded.

Model Development

Full Model

The initial, full model was a time-series regression on the futures

prices using daily closing prices.

IEFi

= β0

+ βED×EDi

+ βTU×TUi

+ βFV×FVi

+ βTY×TYi

+ εi

εi

~ ARIMA(p,

1, q)

where

- ED

is Eurodollar futures

- TU

is the 2-year Treasury note futures

- FV

is the 5-year Treasury note futures, and

- TY

is the 10-year Treasury note futures.

The initial fit selected p

= 3 and q

= 4, giving an ARIMA(3,1,4) model for the residuals.

I assumed that the FV and

TY

futures would be necessary for modeling IEF

since the futures would, essentially, create a bar-bell portfolio which

matched the average maturity of the bond fund. I included ED

in case the ETF, which pays monthly dividends, was sensitive to

short-term rate movements. I included TU simply for completeness, without

expectation it would be a significant predictor.

Reduced Model

The TU

proved to be insignificant, which was not surprising. The ED

term was also insignificant, which was reasonable but a little

surprising.

I was quite surprised, however, that the FV

term was also insignificant. Evidently, the 10-year futures, TY,

is sufficient to mimic the fund behaviour without the 5-year bar-bell

component. The final, reduced model was

very simple:

IEFi

= β0

+ βTY×TYi

+ εi

εi

~ ARIMA(p,

1, q)

A re-fit of the ARIMA model gave p

= 1 and q

= 2, for a final ARIMA(1,1,2) model of ε. The

indicated

hedge ratio was approximately 1,308 shares of IEF for each TY contract.

Model Assessment

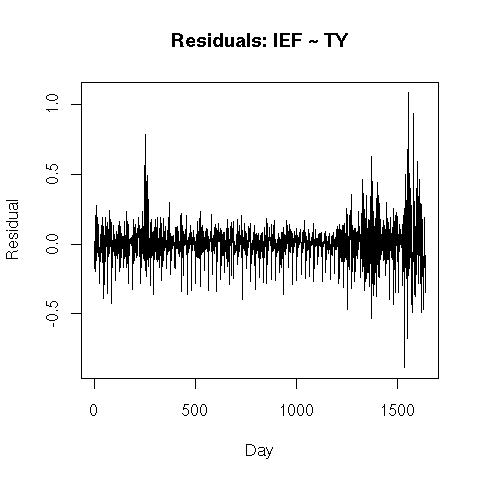

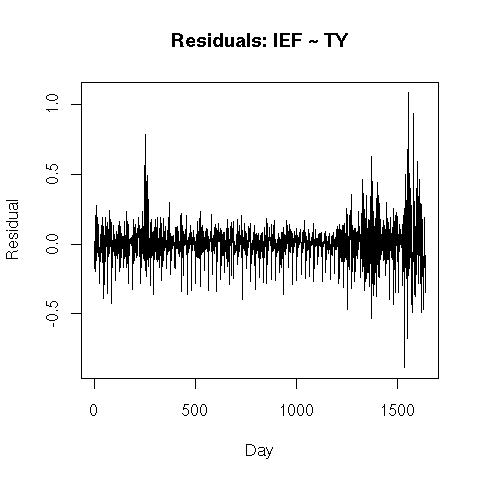

The model residuals are mostly clean and show no bias.

An obvious problem is the explosion in variance in the recent residuals

(extreme right-hand side). I assume this is caused by the

unprecedented conditions during the financial markets'

melt-down

of 2008. From a modeling standpoint, it suggests that the

market

has entered a new regime, and the model may require a local re-fit.

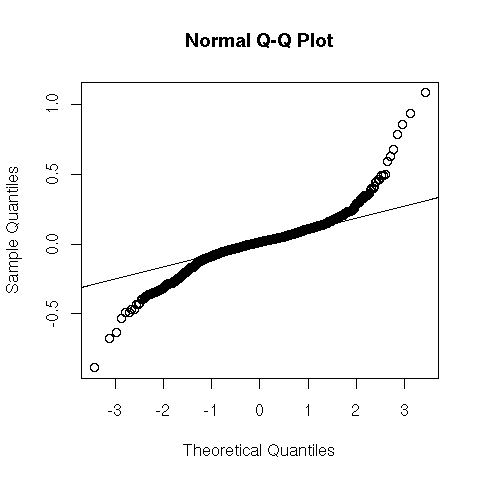

The variance explosion is echoed in the Normal quantile-quantile plot

of the residuals.

Clearly, there are out-sized residuals, as indicated by the fat tails.

This casts some suspicion on the model, but might be

explained by

the excessive market volatility of 2008.

Testing the residuals for mean reversion gives a p-value

of essentially zero, using

the Augmented Dickey-Fuller test, so we can be confident they are

mean-reverting. This is no surprise after seeing the

plot of

residuals, above.

Conclusions

The main result here is that the 10-year Treasury Note futures (TY)

seem sufficient for hedging the

IEF stock. This is a welcome result because the spread trade

is

quite simple and does not require a basket of futures contracts.

A second result is that the model's residuals are historically

mean reverting, creating the opportunity for mean-reversion trades:

the residuals act as indicators of over- and under-valuation,

letting us enter the spread at opportune times. This chart of

recent residuals

illustrates some typical opportunities.

Notice that the mispricing strayed from zero, but reliably returned to

the mean.

The extremes of those deviations represented trading

opportunities.

Limitations

This is only a preliminary study. A deeper study could

address

these issues, among others.

- The study used closing

prices, which are dissynchronized between

the futures market (3:00 PM Eastern) and the stock market (4:00 PM

Eastern). The unmatched closing times inevitably introduce

unwelcome noise into the model.

- The recent large

variance in the residuals needs further

research. Will a simple re-fit of the model to recent data

eliminate the excess variance, including the fat tails in the Q-Q

diagram?

- This study used Perpetual

Data® from Commodity Systems Inc.

for futures

prices. This is convenient for a quick study, but should

probably

be replaced by roll-forward data in order to improve the model's

credibility.

Acknowledgments

I am grateful to Art Margulis of Cognitive

Capital for suggesting the

idea of trading some ETFs as if they are fixed-income instruments.

I am also grateful to Mohamed Amezziane of DePaul University

for

his constructive comments on fitting the model.